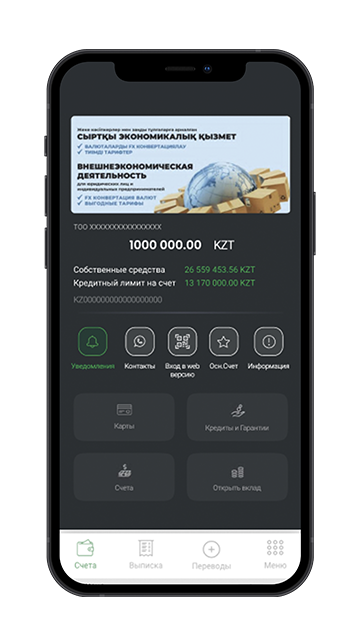

BCC Business

Anytime. Anywhere. Yours

Подключите KazToken к USB

Для начала процесса регистрации ключей необходимо убедится в том, что токен подключен к USB-порту вашего компьютера

BCC Business

Anytime. Anywhere. Yours

Подключите KazToken к USB

Для начала процесса регистрации ключей необходимо убедится в том, что токен подключен к USB-порту вашего компьютера

BCC Business

Anytime. Anywhere. Yours

Подключите KazToken к USB

Для начала процесса регистрации ключей необходимо убедится в том, что токен подключен к USB-порту вашего компьютера

BCC Business

Anytime. Anywhere. Yours

Подключите KazToken к USB

Для начала процесса регистрации ключей необходимо убедится в том, что токен подключен к USB-порту вашего компьютера

BCC Business

Anytime. Anywhere. Yours

Подключите KazToken к USB

Для начала процесса регистрации ключей необходимо убедится в том, что токен подключен к USB-порту вашего компьютера

BCC Business

Anytime. Anywhere. Yours

Подключите KazToken к USB

Для начала процесса регистрации ключей необходимо убедится в том, что токен подключен к USB-порту вашего компьютера